Do Kwon maintains that the charges against him are invalid and that LUNA was never a scam but only a failure

Following the collapse of the Terra blockchain, its crypto LUNA and its algorithmic stablecoin UST ; the founder of the entire ecosystem, Do Kwon was charged by the South Korean government for violating the Financial Services Commission’s Capital Markets Act. An international arrest warrant has been issued in this regard and Do Kwon’s whereabouts remain unknown at the moment. What happened to the Terra founder after these accusations? Complaining about the misinformation and over-politicisation of the case, Kwon gave crypto journalist Laura Shin an interview on the 18th October 2022. He recounts his defence against the charges and explains his reasons.

What happened after the LUNA collapse: charges and arrest warrants

After Terraform Labs and Do Kwon were accused of violating South Korea’s financial markets law, the Seoul Southern District Prosecutor’s Office obtained an arrest warrant in September 2022 for Kwon, who had been living in Singapore since after the collapse of LUNA and UST. A few days later, the Singapore police stated that the crypto entrepreneur was no longer in the city-state and his whereabouts have since been untraceable. As a result, it was reported that Do Kwon was a fugitive. Subsequently, Kwon also received a ‘red notice’ from Interpol, i.e. an international arrest warrant asking local law enforcement agencies to locate and provisionally detain a person and make him available to the judicial authority that originally requested the arrest.

Do Kwon’s defence argues that the Financial Markets Act can only be applied to securities, and LUNA as a cryptocurrency is not legally a security. The accusation would therefore be unfounded, because Kwon and his company would not have done anything illegal. A spokesperson for Terraform Labs explained to the Wall Street Journal how South Korean prosecutors had broadened the definition of ‘security’ in response to public pressure over the bankruptcy of UST and LUNA, which has since been renamed ‘LUNA Classic‘: ‘We believe, as do most in the industry, that LUNA Classic is not, and never has been, a security, despite changes in interpretation that Korean financial officials may have adopted recently’.

What happened to Do Kwon, the founder of Terra?

To sum up, after the charges and various arrest warrants, Do Kwon:

- Claims that the charges brought against him by South Korea are invalid since there is no real crypto regulation in the country;

- Did not respond to the Interpol arrest warrant because he says he never received it in person;

- Confirms that he is not a fugitive;

- Reiterated that he had not set up any scam and that LUNA and UST were a failed market experiment;

- Took full responsibility for the matter and apologised to the holders and supporters of the project.

Let’s look at these points specifically.

Where is Do Kwon?

In this delicate situation, Do Kwon unexpectedly gave an interview on the 18th of October with the aim of shedding light on the events and challenging some false information. This is the second time that Do Kwon has publicly exposed himself after the more than $40 billion collapse. The interviewer is Laura Shin, a crypto journalist who edits the podcast “Unchained” and recently published the book “The Cryptopians”, from which a TV series is to be made by producers Playground Entertainment.

The interview can be divided into two parts, the first focusing on the political and judicial events involving the founder of Terra, and the second on the technical aspects of the collapse of UST.

During the interview, Kwon reiterated the issue of ‘securities’, suggesting that the accusations by South Korea’s Financial Services Commission are not lawful and not even within their jurisdiction. In Kwon’s view, the case of the crypto LUNA is just a pretext to regulate the market by exploiting a moment of crisis. After all, he pointed out, there is no clarity among governments around the world on the issue: are cryptos securities?

Asked by Shin why he had not responded to the arrest warrant, Kwon explained that he had never personally seen this document and that news of his arrest warrant had only reached him through the media, and with contradictory reports. On the issue of ‘absconding’, Kwon repeated what he had already expressed in a tweet, namely that he is not hiding but does not want to reveal his whereabouts for security reasons. Since May 2022, Do Kwon received ‘visits’ and attempted break-ins at both his Singapore and Seoul residences from people embittered by the collapse of Terra. Therefore his whereabouts remain a mystery also to protect his family and associates. This is why Kwon has neither confirmed nor denied that he is in Singapore at the moment, while assuring that he is not a fugitive and is not making efforts to escape. Among other things, Kwon is not worried about losing his Singapore passport.

Do Kwon also denied reports that some of his funds (USD 67 million) had been blocked, claiming that the reports were untrue.

Do Kwon explains the causes of UST’s failure

Shin led the discussion on the reasons behind the failure of the UST algorithmic stablecoin, asking whether the algorithm was in fact insufficient to maintain the peg to the dollar. Do Kwon replied that the algorithm was fully functional and that in designing UST, the Luna Foundation Guard had never taken on the role of ‘market maker‘ to defend the stablecoin peg. However, its intervention had only been necessary on a few occasions. At one point Bitcoin reserves were used to bridge the volatility of UST. Kwon pointed out that Bitcoin (and Avalanche) purchases prior to the collapse had the sole purpose of making UST backed by all the large and promising cryptocurrencies.

For Kwon, the algorithmic stablecoin failed not because of the algorithm but because the economic system that supported it was not sufficiently robust.

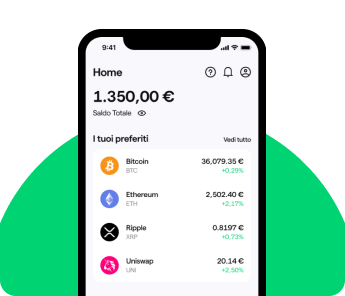

Between the 7th and 8th of May 2022, when UST slowly started to lose its peg, Kwon didn’t think it was a big problem because stablecoins develop through cycles, and time would solve the problem. In the following days, he decided to use LFG funds to buy UST (buy-back) but in the meantime the price of LUNA dropped dramatically because people started to panic sell.

Kwon explained that, at the moment, the distribution of the LUNA 2.0 tokens is not proceeding as planned because the LFG is unable to dispose of its digital assets due to the ongoing process. He has no idea when the situation might be unblocked, Kwon is keen to emphasise that this is not a ‘refund’. Terra’s project has never been like a shop that provided goods in exchange for money and was ready to refund if it did not work out. Shin asked whether Kwon’s personal funds could help compensate for the losses and he replied that they would not be enough to make up the difference.

The intentions and regrets of Terra’s founder

Do Kwon, urged by his interviewer, took the opportunity to apologise to the people who lost money by believing in LUNA, saying that it is not at all easy to live with this responsibility. However, Kwon points out that LUNA was never a scam but only a market experiment gone wrong. He was the first to believe in the project and that he has always tried to build on the values of transparency and integrity. In short, failure does not necessarily mean scam. According to Kwon, it is his duty to provide a correct representation of the facts in order to put those who continue to work in the Terra ecosystem in the right light (he denies that he is still involved in the project).

Do Kwon concluded the interview by saying that his life is currently in a phase of reflection and that he will need a couple of years to humbly process and internalise what has happened: Terra, LUNA and UST ‘were never about money, fame, success’. Kwon continues to believe in the need for an algorithmic and decentralised stablecoin and is still keen to contribute being very young. Any regrets? Kwon would have liked to focus more on Terra’s technological development in the expansion phases rather than on the public relations part. He would also have liked to build a dialogue with people on social media instead of sounding a bit arrogant.

Paraphrasing, Kwon said ‘I think the hardest thing about the current situation is having to come to terms with an astronomical loss. It is difficult to put into words, but the magnitude of the financial, emotional and economic damage that has occurred is not easy to bear’.