What impact will the US election have on the price of Bitcoin? According to Standard Chartered, they could cause the cryptocurrency to explode to the upside.

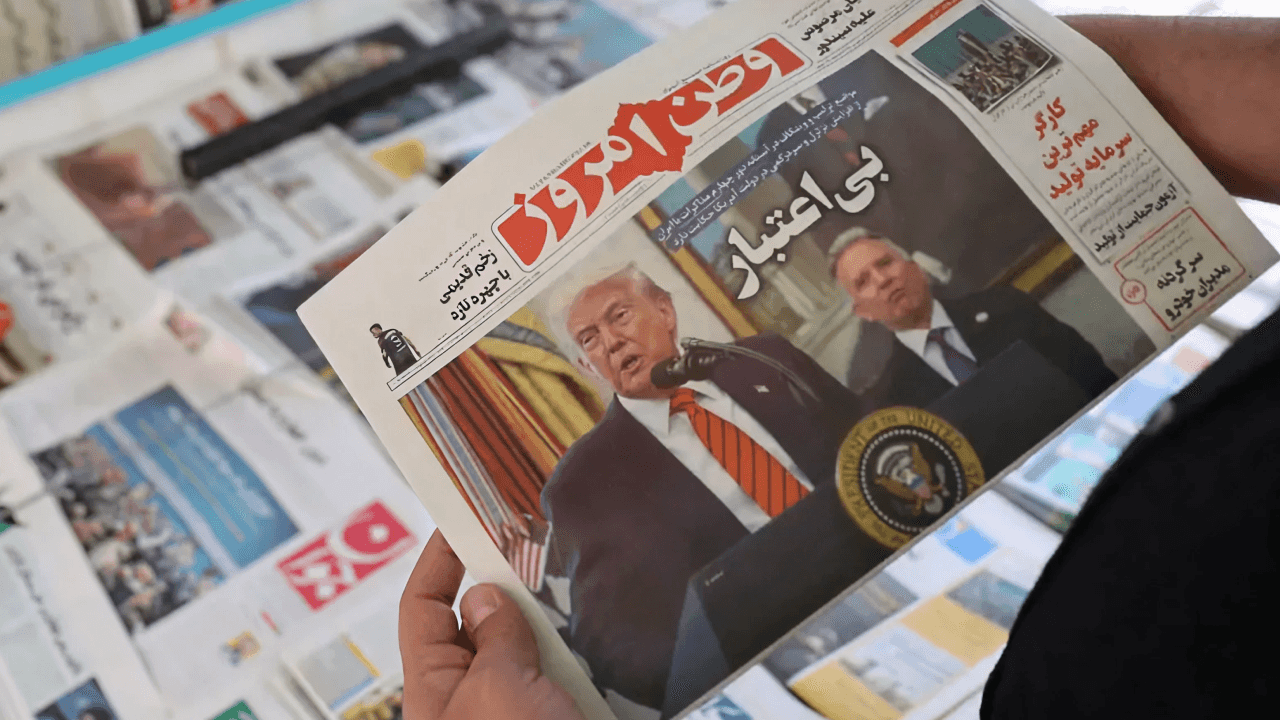

Many analysts believe Donald Trump’s victory in the upcoming US elections could favour Bitcoin and the cryptocurrency sector. Standard Chartered Bank, one of the UK’s most important financial companies, supports this thesis.

What is the basis for this belief’s recent spread? Should Donald Trump return to the White House, where could the price of Bitcoin go? Standard Chartered has updated its BTC price forecast to $150,000 by the end of 2024.

Buy Bitcoin!

US elections: Why could a Trump victory be good?

The first aspect to consider in estimating the impact of Donald Trump’s inauguration on Capitol Hill is the regulatory one. The tycoon has reiterated several times that he has no intention of repressing the use of Bitcoin and, therefore, would not oppose the cryptocurrency sector should he win the US elections. One of the last statements on the subject dates back to March when Trump said on CNBC’s microphones that he was aware of and accepted the phenomenon, even though he reiterated his total and unconditional support for the dollar.

Another theory that accompanies the belief of those who expect a bullish crypto market in the event of a Donald Trump victory is related to the incumbents at the head of key government institutions. Should Joe Biden’s term, and with it the current Democratic term, come to an end, some heads could ‘jump’.

The industry’s eyes are mainly on Gary Gensler, the chairman of the Securities and Exchange Commission (SEC) and its biggest antagonist in recent years. Gensler has long been linked to the Democratic Party, and therefore, a rise to power of the Republican faction could put his chair at risk.

As proof of this, in a video recently made public on X (formerly Twitter), Trump states that ‘they’, referring to the Democrats and Gary Gensler, are hostile to cryptos and jokes that, according to him, Joe Biden doesn’t even know what they are. In short, cryptocurrencies could find fertile ground within the institutions should Trump win the US elections on 5 November 2024.

Will Trump inject liquidity into the markets?

It is indeed worth noting that Donald Trump has favoured highly expansive monetary policies characterized by near-zero interest rates and debt monetization. These policies could have a significant impact on the price of Bitcoin in the event of his re-election in the 2024 US elections. This term refers to the tendency of governments to use central banks as buyers for their debt. In other words, when this scenario occurs, the Federal Reserve (FED) would issue new money to buy US government bonds. This scenario is particularly attractive when the public debt of the country in question is particularly high and, above all, when there is a risk that the markets begin to doubt its sustainability.

But what impact would this forcing of the economy have on the cryptocurrency sector? The only way to estimate this is to analyse data from the last Trump term, when interest rates were close to zero, such as ‘confidence’ in the US treasury market or US government bonds. Suffice it to say that during the first term, the average annual net sale of US government debt reached USD 207 billion, compared to USD 55 billion during the Biden presidency. The crypto and stock markets boomed at that juncture as they provided a hedge against de-dollarisation. One of the side effects of this practice is, in fact, currency devaluation, which is generated by increasing the amount of money circulating in an economic system.

Bitcoin price predictions

Having clarified the economic and regulatory environment, it is time to address the possible influence of the US elections on the price of Bitcoin. Obviously, it is impossible to know what will happen should Donald Trump return to the White House, but this does not stop industry commentators from publishing their predictions.

Standard Chartered’s, already anticipated in the introduction of this article, had more media resonance. For the UK bank, the price of Bitcoin will reach $150,000 by the end of 2024 should Donald Trump become the US president for the second time in history. But that is not all! According to Geoff Kendrick, Head of Crypto Research at the financial company, the value of a single Bitcoin could touch $200,000 in 2025.