VanEck’s forecast of Bitcoin’s value in 2050 offers an in-depth look at the cryptocurrency’s potential to become a central element in the international monetary system.

What does the future hold for us? What do VanEck’s predictions for 2050 contained in a recently published analysis say? According to the investment fund, Bitcoin could establish itself as a key component of the global monetary system, ‘stealing market share’ from major fiat currencies globally.

Specifically, Van Eck predicts that Bitcoin will be widely used in international trade, become one of the most commonly used means of exchange and an even more valuable store of value. Here are VanEck’s Bitcoin predictions for 2050.

Bitcoin: the future of the international monetary system

To produce his predictions on the price of Bitcoin by 2050, Van Eck started with some estimates on global Gross Domestic Product (GDP) and growth. The scenario drawn by the hedge fund predicts that populist movements and the desire for re-shorting will cause global GDP growth to slow from 3 to -2%.

He then analysed the international monetary system (IMS) in a broader sense, predicting a shift of world economies away from traditional reserve currencies.

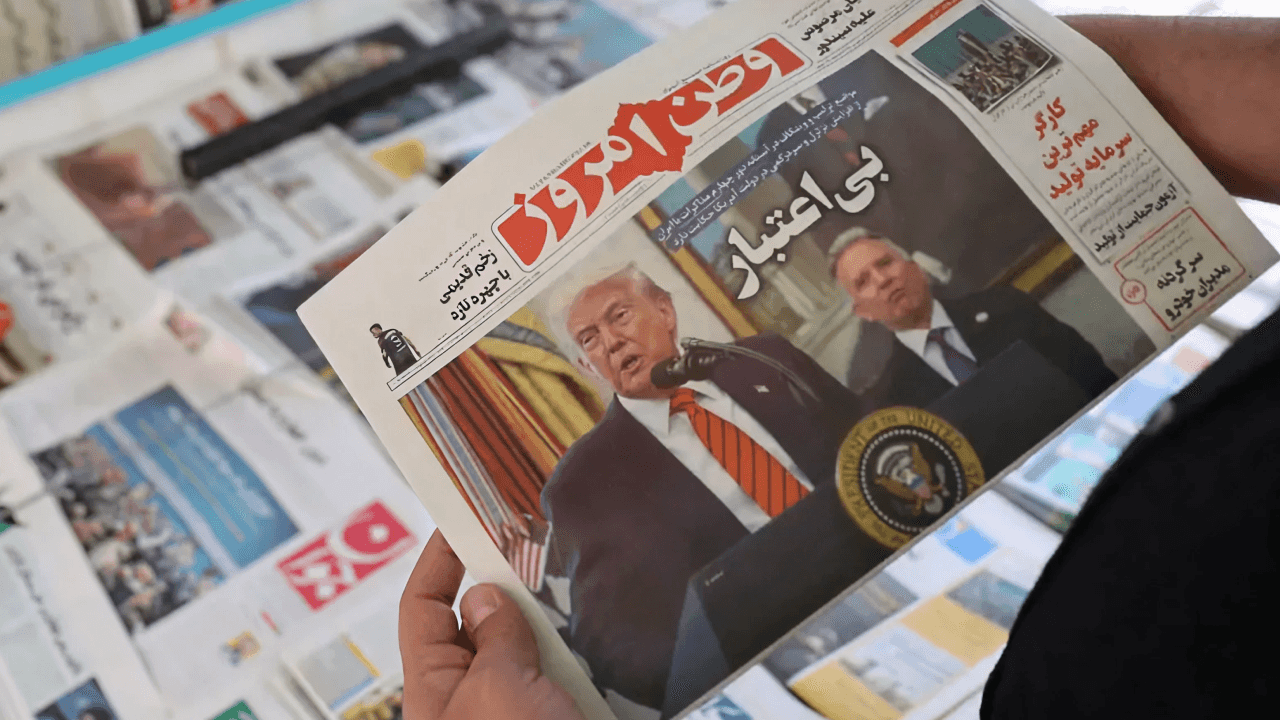

The US, EU, UK and Japan are gradually losing share in this respect. In addition, the decline of confidence in fiat currencies as long-term stores of value due to continuous and excessive deficit spending – when a government (and thus a central bank) or a company spends more than it collects by financing itself through the issuance of debt, be it public or private – is increasingly evident.

In short, VanEck argues that the gradual erosion of trust in traditional fiat currencies and the emergence of Bitcoin as a store of value are the main catalysts for a radical change in the global monetary system. BTC is set to carve out a prominent role in international transactions and within state reserves.

Why will Bitcoin emerge?

VanEck predicts that Bitcoin could establish itself as one of the main instruments for exchanging value globally while at the same time attaining the status of a universally recognised store of value, a role historically held by gold. This is mainly because of the growing erosion of confidence in fiat currencies that we analysed in the previous section, but also due to a substantial change in the global monetary balance of power.

The foundation of Bitcoin’s success lies in some unique characteristics that make it particularly relevant, especially in developing countries:

- Immutable property rights: Thanks to its decentralised blockchain, Bitcoin cannot be censored, confiscated, or stolen. This feature is particularly relevant in contexts where traditional systems are vulnerable to manipulation, corruption, or political instability.

- Sound money principles: This concept describes a currency that retains its value over time and is not subject to uncontrolled inflation or manipulation by governments and central banks. With a supply limited to 21 million units, Bitcoin represents an ideal model of sound money.

One of the main obstacles to the adoption of Bitcoin is the limited scalability of its network, a critical issue that is finding solutions through the implementation of Layer-2 blockchain.

These networks improve Bitcoin’s scalability, allowing more transactions to be finalised without compromising its fundamental characteristics. The combination of immutable property rights, sound money principles, and technological innovation provided by Layer-2s paves the way for the creation of a global financial system capable of effectively responding to the needs of emerging countries.

Bitcoin 2050 predictions: what does VanEck tell us?

After analysing where BTC might be during the next chapter of its evolutionary history, let’s see what VanEck’s predictions say about Bitcoin’s price. According to VanEck’s estimates, by 2050, Bitcoin could be used to settle 10% of international trade. Furthermore, the investment fund predicts that many central banks will hold at least 2.5% of their assets in BTC.

This scenario, at least as far as the US is concerned, is on its way to becoming reality. A proposal under discussion in the US Congress, known as the Bitcoin ACT, aims to convert part of the US’s gold reserves into Bitcoin.

In any case, VanEck’s forecast takes three main factors into account: first, the GDP of local and international trade regulated on Bitcoin; then, the circulating supply and velocity of the asset. The latter represents the frequency with which a monetary unit, in this case BTC, is used to conduct transactions within an economic system in a given period. It measures how quickly money or its equivalents ‘circulate’.

Bearing in mind Bitcoin’s possible role as one of the cornerstones of international trade and an asset in most of the world’s central bank coffers, and applying a given velocity coefficient to this scenario, VanEck stated that Bitcoin’s value could reach $2.9 million per unit, with a total market capitalisation of $61 trillion.

The price forecasts in this article are based on sources believed to be reliable, but do not guarantee the market’s future performance. They do not constitute a recommendation or financial advice. Investing in crypto-assets involves risks, including the potential loss – even total – of the invested capital. Users are required to conduct independent evaluations before making economic and/or investment decisions and to consult their own specialised financial advisor.