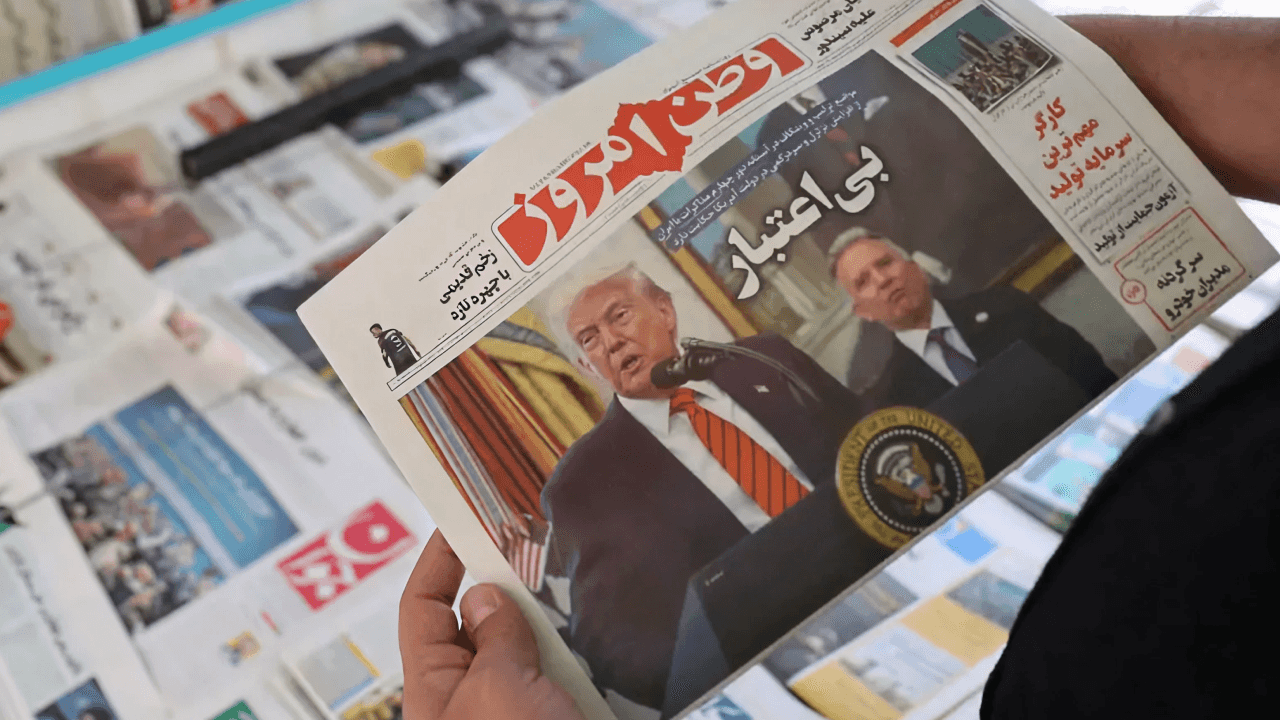

Is it still wise to invest solely in S&P 500 ETFs? We compare this traditional strategy with Bitcoin.

The long term is generally considered safe, but as Keynes noted, “In the long run, we are all dead.” The idea of the long run is often associated with investing in assets that have a medium to high risk and volatility profile, as time is the key factor that increases the likelihood of a positive return.

But is the best investment strategy really to simply buy an ETF that tracks the S&P 500 and wait 30 years?

The time horizon in which one invests is a personal factor

The statement that concludes this introduction is likely something you’ve heard before, and it holds a kernel of truth. Since the 1980s, the main index of the US stock market has increased by over 6000%. However, the investment horizon varies for each individual, primarily depending on the investor’s goals.

While a longer investment horizon—especially for equity investments—can increase the likelihood of achieving a positive return, it’s essential to recognise that this probability will never reach 100%. In other words, a risky investment can never guarantee a predictable return.

Time is our greatest ally as investors. Unless we want to bet against the market, it’s best to let it work in our favour. Time also enables us to maximise the benefits of compound interest, which is essential for achieving outstanding results over the long term.

While compound interest drives returns on established indices like the S&P 500, the modern market also offers instruments that promise exponential growth in potentially shorter timeframes, albeit with varying degrees of risk. This perspective aligns perfectly with the ongoing debate surrounding Bitcoin.

The alternative: Bitcoin

The approval of spot Bitcoin ETFs in January 2024 made an investment that was previously confined to complex procedures accessible to a wider audience. This raises a question: Can Bitcoin, or its ETFs, serve as an alternative or complement to the S&P 500 in a long-term portfolio?

The most obvious argument in favour is related to the potential asymmetric return: against a risk of total loss, there is a growth potential of several orders of magnitude, much higher than that of a mature index. Theoretically, then, Bitcoin could also act as a diversifier, given its historically low correlation with equities, although this tends to increase during periods of high financial stress.

However, the critical points are equally important. The first is extreme volatility. While the S&P 500 has suffered 30-50% crashes in conjunction with epochal crises, Bitcoin has regularly experienced 7 drawdowns of 0-80%. A very long time horizon may not be enough to recover if you enter a market peak.

Second, unlike the S&P 500, which represents the ownership of real companies that generate profits, Bitcoin does not produce cash flows. Its value is driven solely by the law of supply and demand, relying on trust and its planned scarcity. This makes it more like a digital commodity than a productive investment. Finally, regulatory uncertainty should not be overlooked: as a young asset, it is exposed to future regulatory changes that could drastically impact its value.

Conclusion: What is the best strategy?

So, can the Bitcoin ETF stand alongside or even replace the S&P 500 in a long-term perspective? The answer, again, is not unambiguous and goes back to the heart of our discussion: it depends entirely on the risk profile, objectives and awareness of the individual investor.

For those seeking stable, relatively predictable growth based on economic fundamentals, passive investing in the S&P 500 remains the most logical and proven choice.

For those with a very high risk tolerance, who understand the speculative nature of the asset and want to allocate a small portion of their capital to a potentially disruptive technology, an ETF on Bitcoin may be an interesting addition.Ultimately, the question is not which of the two is ‘better’ in absolute terms, but which is the most suitable instrument to help us achieve our personal goals, accepting a level of risk that we can live with peacefully over the long, and sometimes turbulent, period.

The price forecasts in this article are based on sources believed to be reliable, but do not guarantee the market’s future performance. They do not constitute a recommendation or financial advice. Investing in crypto-assets involves risks, including the potential loss – even total – of the invested capital. Users are required to conduct independent evaluations before making economic and/or investment decisions and to consult their own specialised financial advisor.