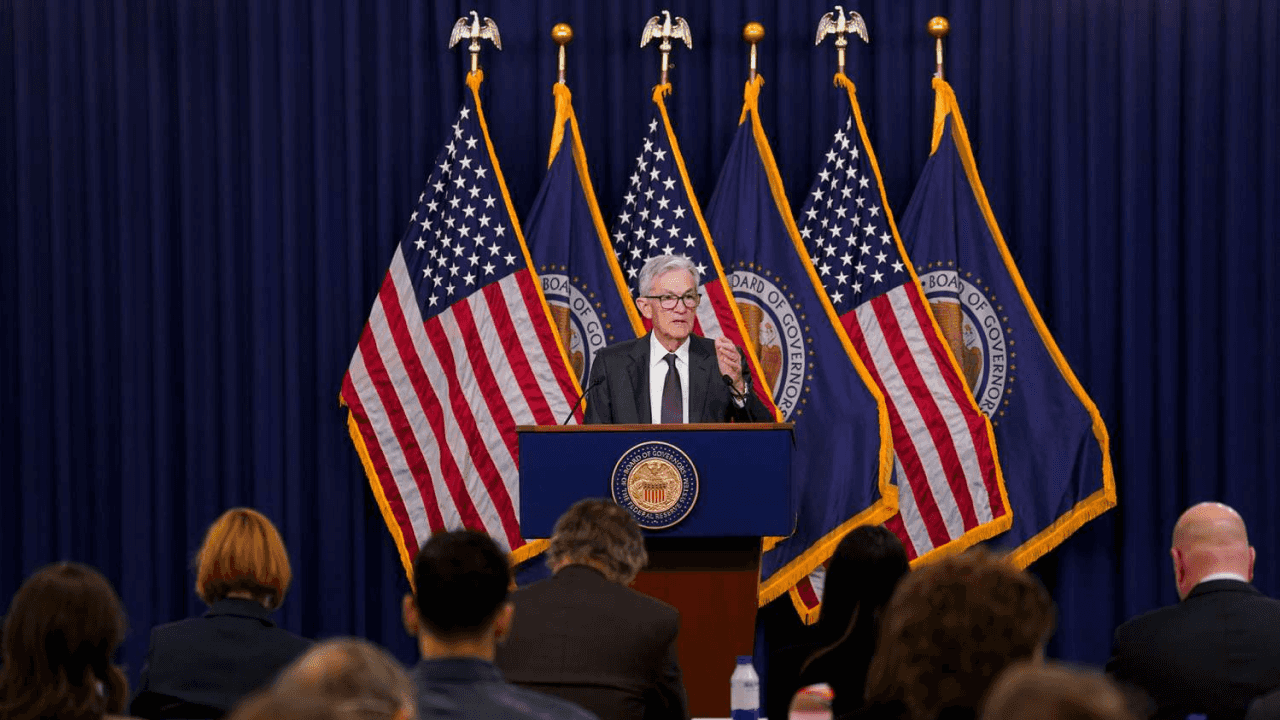

December 2025 Fed Meeting: The FOMC cuts interest rates by 25 basis points (bps). What drove the decision? How did the markets react?

The Federal Reserve meeting concluded on December 10, 2025, with Chair Jerome Powell announcing the FOMC’s decision on interest rates. As widely expected, the Committee opted to cut rates by 25 bps, bringing them into the 3.50%–3.75% range.

December 2025 Fed Meeting: FOMC Cuts Rates as Predicted

At the conclusion of its December 10, 2025, meeting, the Federal Open Market Committee (FOMC) announced its highly anticipated monetary policy decision. The committee, led by Jerome Powell, chose to lower interest rates by 25 basis points to a target range of 3.50%–3.75%, a move that had been broadly priced in by the markets.

The Rationale

The reasoning behind the decision can be summarised in two key statements from Jerome Powell during the press conference.

The first gives us a general overview of the U.S. macroeconomic situation:

“Although some important federal government data have been delayed due to the shutdown, available public and private sector data suggest that the outlook for employment and inflation has not changed much since our October meeting. Labour market conditions appear to be cooling gradually, and inflation remains somewhat elevated.”

Nothing new here. The labour market is struggling to gain traction, with the unemployment rate at its highest level since October 2021—now at 4.4%—while inflation, though relatively under control, shows no signs of entirely stalling. Thus, Powell asserts, the current situation does not differ significantly from September.

Given that the Federal Reserve—as we’ve known since Jackson Hole—now places greater weight on controlling unemployment than on price stability, this substantially unchanged context allows the Governors presiding over the FOMC to continue with an expansionary monetary policy.

Subsequently, the Fed Chair focused on the labour market:

“While official employment data for October and November are delayed, available evidence suggests that both layoffs and hiring remain low. The official labour market report for September, the last one published, showed that the unemployment rate continued to rise slightly, reaching 4.4%. That job gains had slowed significantly compared to earlier in the year.”

Powell is telling us that, in the medium term, the data indicate slightly deteriorating employment. Based on this, the Fed decided to cut rates to stimulate the economy and, consequently, revive the labour market.

The Federal Reserve Returns to Quantitative Easing, but “Soft”

Towards the end of his speech, Jerome Powell focused on the Federal Reserve’s balance sheet. On the first day of December, the U.S. central bank officially ended Quantitative Tightening (QT): it stopped reducing its balance sheet with the intention of keeping it “flat,” or stable.

With the December FOMC, however, “the Committee decided to initiate the purchase of shorter-term Treasury securities—primarily Treasury bills—for the sole purpose of maintaining ample reserve availability over time.” In other words, Powell’s statement signals that the Fed will begin injecting liquidity back into the system to ensure banks have sufficient liquidity to support economic growth.

Specifically, “reserve management purchases will amount to $40 billion in the first month and could remain elevated for some months.”

The Federal Reserve is effectively returning to a Quantitative Easing (QE) regime, but a “soft” version: for comparison, during Covid, the Fed’s QE involved Treasury purchases of $200 billion per month, five times the figure mentioned above.

Oracle Earnings Spoil the Market’s Party

Oracle, the company led by Larry Ellison—which recently dove headfirst into the AI business with multi-billion dollar collaborations with OpenAI and NVIDIA—reported quarterly earnings around 10:00 PM CET (4:00 PM ET) on December 10, after markets closed.

Before this, Wall Street’s three leading indices had responded very positively to the rate cut news: the S&P 500 and Dow Jones were up 0.7%, with the Nasdaq 100 up 0.8%. Focusing on individual companies, particularly in the AI-Tech sector, Oracle closed the session up 1.9%, NVIDIA +0.65%, Broadcom +1.65%, Meta +0.8%, and Tesla and Google +1.4%. The crypto market also joined the party, with Bitcoin and Ethereum up approximately 2.5%.

Then came the moment of truth. Oracle reported earnings for the just-concluded quarter: $16.06 billion, below the expected $16.21 billion. If a company misses forecasts, it’s never a good sign; if that company is a top player in the AI sector, the situation is even more grave. Fears about an “AI Bubble” are taking hold among investors.

This is what happened in the pre-market, with exchanges still closed: S&P 500 futures fell 0.6%, Dow Jones futures 0.2%, and Nasdaq 100 futures 0.8%.

The picture is even worse for individual stocks, with Oracle shares down 11%. Dragged down with them were NVIDIA (-1.73%), Broadcom (-1.6%), Meta (-0.9%), Tesla, and Google (-0.8%). Naturally, the event also hit Bitcoin (-4.4%) and Ethereum (-7.3%) from their post-FOMC peaks.

Next Fed Meetings: Are Rate Cuts on the Horizon?

It is challenging to predict U.S. central bankers’ behaviour, partly because there will be a leadership change at the Fed in May 2026—we have written a dedicated article on potential presidential candidates.

In any case, at the time of writing, the FedWatch Tool, 48 days out from the next meeting, estimates a 19.9% chance of a 25 bps cut, while “No Change” is priced in at 80.1%.The next appointment is in just over a month and a half, at the FOMC meeting on January 30-31. Join our Telegram group or sign up for Young Platform so you don’t miss the relevant market-moving news!