The Consumer Price Index (CPI), used to estimate inflation in the United States of America, has just come out.

The market’s fate depends on US inflation and, thus, on the Consumer Price Index (CPI) figure released today. For several months now, the question has been raised as to when the Federal Reserve (FED) will make its first interest rate cut, and, as its chairman Jerome Powell has repeated to the point of nausea, the decision depends mainly on US inflation. This has been orbiting around the 3% threshold for more than a year and has risen from 3.5% to 3.3% since March.

What does the latest CPI data tell us? On 31 July, the last Federal Market Open Committee (FOMC) meeting this summer, the first interest rate cut since 2020 will take place.

US inflation at what to expect?

US inflation is now at, while ‘core’ inflation, stripped of the more volatile components represented by food and energy prices, is at. This is down from previous months but still far from the 2% target, a threshold considered healthy for the economy.

As we know, this figure is derived from the Consumer Price Index (CPI), an economic indicator used to measure the price development of goods and services purchased by consumers over time. The CPI is calculated by collecting data on the prices of a representative ‘basket’ of goods and services that consumers usually buy. This basket includes various products, such as food, clothing, housing, transport, education, health care and other common goods and services.

Jerome Powell said in a speech this Tuesday: ‘The FOMC only considers a reduction in the target range for rates to be appropriate once it has greater confidence that inflation is moving sustainably towards the 2% target. Who knows whether today’s US inflation figure justifies such a move?

Despite the above statement, which was far from optimistic, the chairman of the FED did, through another statement, give a slight boost to the markets, especially the traditional ones. He stated that: “in case the US cuts rates too late (or too little), it could adversely affect the economic situation.”

In short, as is often the case, the scenario is rather intricate. On the one hand, the Fed might decide to start cutting interest rates, perhaps by 25 basis points, after the joyous news that came out today. On the other hand, the slowdown in inflation might not be sharp enough and, therefore, not justify a rate cut.

The impact of a rate cut

The FED’s decisions on interest rates directly affect people’s daily lives. Higher interest rates mean more expensive loans for house, car and business purchases but offer higher returns to savers who choose government bonds. Conversely, lower rates make loans more affordable but reduce returns on savings. For example, in 2023, 30-year mortgage rates reached an annual high of 7.79% before falling to 7.03% at the end of May 2024.

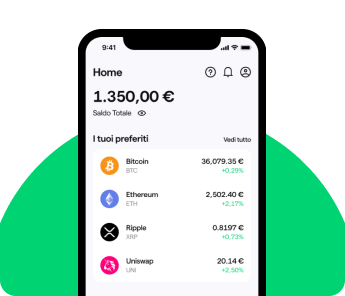

The FED’s decisions also influence the stock and cryptocurrency market volatility. In all likelihood, a more expansive or, as they say in the jargon, ‘dovish’ monetary policy stimulates the performance of these assets, which are considered riskier than bonds. The bull market of 2021, for example, began precisely when the major global economies, above all the US economy, decided to adopt economic policies that would stimulate growth to recover from the severe crisis caused by the COVID-19 pandemic.

Enter the crypto world

We will see whether the latest US inflation figures released today will set the stage for a similar scenario in the months to come or whether, on the other hand, the situation is still delicate, and we will still have to wait several months to see the first interest rate cut.