Smart Trades, the automatic trading strategies, are coming to Young Platform! They are available as a preview for Club members only.

We are happy to announce the launch of a new feature: Smart Trades. This feature was created through a partnership with Aelium, a company specialising in developing cryptocurrency trading strategies. Smart Trades can only be activated in advance by Young Platform Club members. In this article, we will learn what they are, how they work, and what advantages they offer for your cryptocurrencies.

Managing money: a question of time

Many of us feel we have no time. We would like to devote attention to many essential or enjoyable things, but time always seems in short supply. Managing money is one of them.

Understanding financial concepts helps to set and achieve concrete goals, contributing to present and future financial security. It gives peace of mind, opens new opportunities and avoids uncontrolled debt. Developing one’s savings and investment skills increases independence and quality of life.

We firmly believe that the crypto market represents a new opportunity, and our job is to make it available to as many people as possible.

We have always tried to develop tools that are simple and as automated as possible, capable of working even with minimal amounts of money and little time. This way, anyone can try, experiment, and adapt the tools to their situation. Flexibility is our prerogative. We break down any barriers and encourage individual autonomy, starting from the heart of the problem: time.

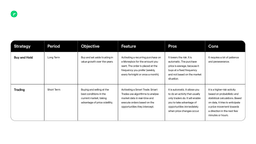

Buy-and-Hold and Smart Trades compared

Today, we want to introduce you to a new tool that complements the Moneyboxes. These were created to automate the buy-and-hold approach over the long term. Buy and Hold is an approach that does not consider price fluctuations and volatility and tries to put cryptocurrencies aside over the years on an ongoing basis. The recurrence of purchases over the long term limits risk and the average purchase price.

The completed approach to Moneyboxes, which we want to tell you about today, is the one introduced by Smart Trades. If Moneyboxes are for ‘buying and saving,’ Smart Trades are for trading. They are, therefore, short-term indicators that execute buy-and-sell trades automatically. Smart Trades seek to exploit volatility, price trends, and breaks in support and resistance to their advantage to achieve results over weeks or months, even if they entail higher risk.

But now, let’s get into the nitty-gritty of Smart Trades to learn what they are, how they work, and what benefits and risks they entail. Above all, we must know how to harness them to achieve our goals.

Remember, the definitions provided here are greatly simplified for a non-expert audience. If you wish to delve deeper into the indicators, we recommend reading the in-depth articles on Academy. It’s crucial to understand that financial markets are intricate and unpredictable, and an indicator’s performance can fluctuate based on numerous factors. Before you proceed, consider your risk profile, investment goals, and time horizon. Also, avoid basing your decisions on a single source of information and always seek advice from a professional who can guide your choices. This table provides some information that may aid your research. But always keep in mind: the final decision is always yours!

What are Smart Trades

Smart Trades are automatic trading indicators that operate without human intervention thanks to an algorithm.

This algorithmic trading type uses mathematical models to execute buy and sell orders based on market signals and predefined parameters. With Smart Trades, even beginners can approach trading.

Algorithmic trading: how it works

Algorithmic trading can execute various trading orders at a higher speed than manually. These systems are programmed to recognise trends, patterns and price discrepancies. Based on this data or signals, they execute fast trades to maximise returns.

An algorithm in trading is a detailed recipe that tells the computer exactly what to do and when. For example, ‘Buy 100 shares of XYZ Corporation when their price falls below 50€ and sell them when their price rises above 60€’. The computer monitors the market 24 hours a day, 7 days a week, and automatically executes these orders when the specified conditions occur, without you constantly tracking the market.

Why activate a Smart Trade?

Activating a Smart Trade offers numerous advantages, especially for beginners. It is a gateway to the trading world that does not require years of experience or constant market monitoring. Smart Trades reduce the emotional factor, one of the biggest obstacles for traders, and allow a more disciplined, data-driven approach. In addition, they will enable you to take advantage of market opportunities 24 hours a day, 7 days a week.

How to Choose a Smart Trade

Before activating a Smart Trade, it is important to carefully evaluate each strategy, understand the associated risks, and determine which best aligns with your objectives. The app describes each strategy’s characteristics, and you can read the complete guide to help you interpret and use them in your choice.

How Smart Trades are activated

Activating a Smart Trade on the Young Platform is simple and intuitive. They are currently only available on the Young Platform app, not the web version. After selecting the strategy that best suits your needs, follow this step-by-step tutorial. Simply enter the amount to be allocated and check the summary data before confirming. Once configured, the Smart Trade will start trading automatically, allowing you to monitor progress and make necessary changes. For more details on the functionality, please read our Terms and Conditions and Aelium’s Terms and Conditions.

Smart Trades available on Young Platform

Each of the four proposed strategies works on different parameters. You can read the Academy’s in-depth article on a strategy by clicking on it in the following list:

- Keltner Channels

- Supertrend

- Momentum

- Bollinger Bands

Cryptocurrencies available for Smart Trades

The cryptocurrencies available for use with Smart Trades include some of the most popular and liquid ones on the market:

- Bitcoin (BTC)

- Ethereum (ETH)

- Solana (SOL)

- Arbitrum (ARB)

- Chainlink (LINK)

- Avalanche (AVAX)

- Optimism (OP)

- Dogecoin (DOGE)

- Polkadot (DOT)

- Polygon (MATIC)

This selection of cryptocurrencies allows diversifying one’s strategies across different assets, taking advantage of each coin’s unique characteristics.

Smart Trade Monitoring

To monitor the gains and losses of your Smart Trades, access the ‘Smart Trades’ section of the app. In the ‘Active’ tab, find and select the strategy of interest to view the details. Here, in the Profit&Loss (P&L) section, you can analyse the performance of your plan, checking the percentage increase or decrease and the amounts gained or lost. If you wish to increase your budget, you can easily do so by using the ‘Add Funds’ button on the same detail screen. By following these simple steps, you can actively manage and monitor the effectiveness of your automatic trading strategies on the platform.

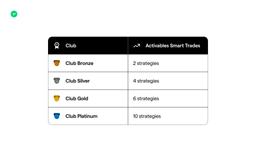

Smart Trades that can be activated

Smart Trades can only be activated in advance for Clubs. If you do not belong to a Club, you can only activate one Smart Trade at a time, but by joining a Club, you can unlock many more.

The availability of these strategies varies according to Club membership.

What fees are applied to Smart Trades?

During the preview period for Club members, a fixed commission of 0.2% will be charged on the transaction amount. Please note that fees may change once the feature becomes available to the public. It’s important to mention that no commission discounts will be applied to Smart Trades, including those offered by the Club subscription or acquired bonuses.

Young Platform does not provide tax, investment, or financial services and advice. The information on this website is provided for informational purposes only. It is presented without regard to any specific investor’s investment objectives, risk appetite, or financial circumstances and may only be suitable for some investors. Buying and selling cryptocurrencies involves risks, including total loss of capital. Users should always research, consult a qualified professional before deciding, and carefully assess their risk profile and loss tolerance.