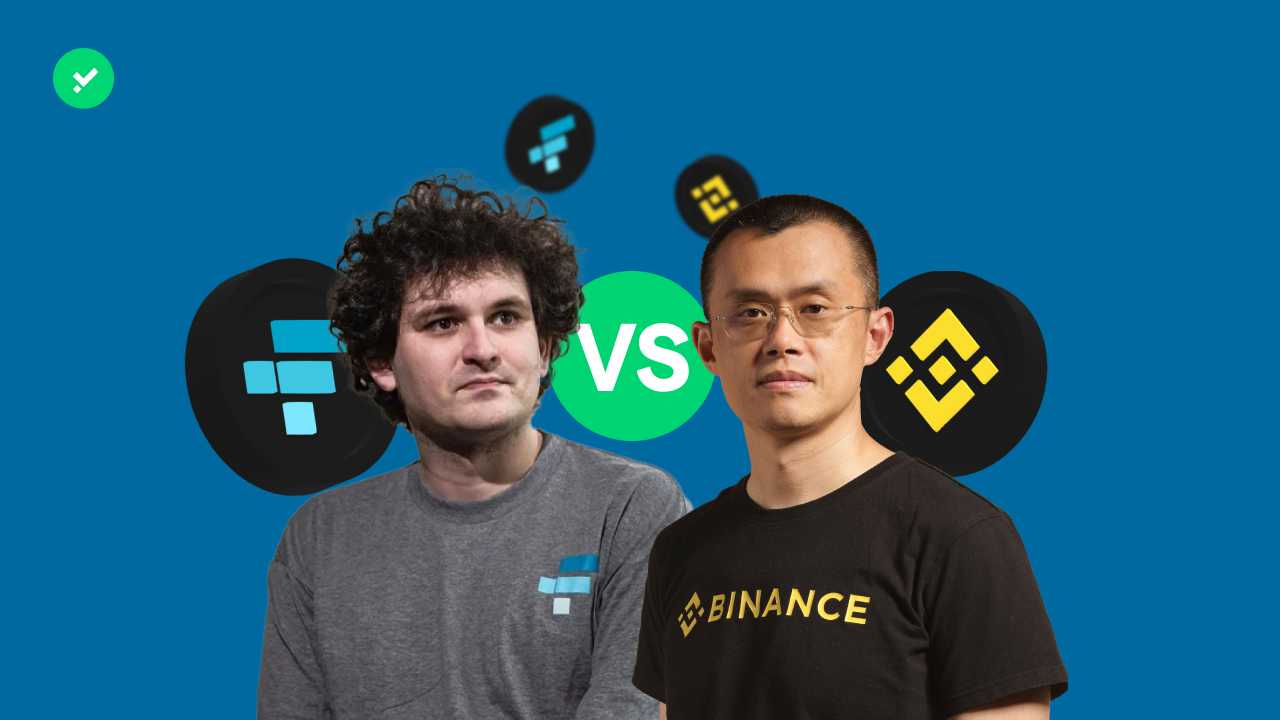

The Binance and FTX case explained point by point. What is happening in the crypto world? How is the community reacting?

2022 is turning out to be a busy year for the cryptocurrency sector. In recent days, a succession of events, from Binance’s sale of FTT tokens to the news of the FTX exchange’s bankruptcy, has shocked the market ; which is currently experiencing a major decline. In this article, you will find an account of the story in all its passages and the reactions of the community. What is happening in the crypto world?

Who is involved in the affair?

Before getting to the heart of the matter, let’s summarise who the main actors involved are:

- Binance: one of the largest and most widely used centralised cryptocurrency exchanges, founded in 2017 and based in the Cayman Islands;

- Changpeng Zhao: CEO and founder of Binance, also known as CZ;

- FTX: another centralised exchange, founded in 2019 and based in the Bahamas. Its utility token is FTT;

- Sam Bankman-Fried: also referred to by the initials SBF, founder of FTX and Alameda Research;

- Alameda Research: a trading company whose CEO is Caroline Ellison. Alameda Research was founded by SBF and is these days accused of being not so transparently connected with FTX.

The relationship between Binance and FTX over the years

Binance and FTX are two of the leading centralised exchanges (CEXs) competing for supremacy in the crypto sector. Last year they generated 30% of all trading volume on CEXs together, totalling $27.5 trillion. Binance and FTX have not always been business rivals, in fact the two companies have been very close in the past. In 2019 Binance was one of FTX’s earliest backers and investors, and the partnership between the two exchanges continued until 2021 when FTX bought back its shares in Binance for $2.1 billion, most of this sum was settled in FTT tokens.

The crucial moments of the Binance vs FTX saga

Twitter has become the stage for all the key events in the crypto world. In order not to get lost in the memes, let’s clarify by following all the steps of the Binance-FTX affair.

• 6/11: CZ announces that Binance will sell all its FTT tokens

With a tweet on his personal profile, CZ announced on the 6th of November that he would be selling all FTT tokens held by Binance, due to ‘recent revelations that have come to light’. On this occasion CZ assured that the Binance team would try to minimise the impact on the market of this transaction (spoiler: the crypto market devolved into chaos) and that the decision was made looking at the mistakes that were made in the past with LUNA, the crypto that collapsed in May 2022. The founder of Binance also explained that this was in no way a move to harm a competitor.

Within hours of the publication of this tweet, the price of the FTT token dropped more than 10%. CZ’s decision threw users into a panic (ever heard of FUD?) and in 72 hours more than $6 billion was withdrawn from FTX.

• What are the ‘recently emerged revelations’ CZ is talking about?

The ‘revelations’ referred to by CZ are rumours about the financial difficulties of FTX and Alameda Research. On the 2nd of November, CoinDesk published a report on the financial state of FTX and Alameda Research. Alameda’s balance sheet showed that the trading company is ‘heavily’ dependent on the FTT token, which it uses as collateral. In other words, the FTX exchange would be involved with Alameda much more than SBF has always claimed. For CZ this proved problematic, as the lesson learned from the collapse of Terra (LUNA) is: “never use a token that you created yourself as collateral”. In general, FTX and SBF have been accused of a lack of transparency.

Reinforcing these allegations, Reuters claims that FTX secretly transferred USD 4 billion to Alameda between May and June.

• 6/11: Caroline Ellison of Alameda denies everything

The managing director of Alameda Research, Caroline Ellison, denied the rumours circulating about the trading company, explaining that Alameda also owns other assets besides the FTT token. Ellison also proposed that CZ buy Binance’s FTT tokens for $22 each.

• 7/11: SBF’s denial makes an appearance (now deleted from Twitter)

On the 7th of November, SBF wrote on Twitter that all rumours are unfounded: ‘a competitor is trying to attack us with false rumours. Assets are fine’. The tweet, however, was deleted.

• 8/11: FTX blocks withdrawals and news of takeover arrives

After the blocking of withdrawals on the FTX exchange, news came of a possible takeover by Binance. CZ stated that FTX had asked for Binance’s help and that the acquisition would have the protection of users as its primary purpose. The founder of Binance then signed a non-binding agreement.

• 9/11: Justin Sun at work with FTX

On the 9th of November, Justin Sun, the founder of the Tron blockchain, said he was working with FTX to find a solution and protect the holders of Tron tokens on FTX.

• 10/11: Binance backs off

‘Following corporate due diligence and the latest news regarding the mismanagement of client funds and alleged investigations by US agencies, we have decided not to pursue the potential acquisition’. With these words, CZ announced that Binance would no longer buy FTX. In a series of tweets, CZ went on to explain how the failure of FTX is a defeat for the entire industry and that regulation of crypto is likely to be increasingly aggressive from now on.

• 11/11: FTX files for bankruptcy

After scrambling for funds (about $9 billion) to solve liquidity problems, on the 11th of November, SBF resigned as CEO of the exchange and FTX filed for bankruptcy.

The secondary effects of the FTX crisis

On the 10th of November, the crypto market opened with -16.1% for BTC, -24.1% for ETH and -43% for SOL. The uncertainty of the situation made itself felt. The crypto that seems to be suffering the most in this situation is SOL, Solana’s coin. Why SOL in particular? SBF has always been a supporter of Solana, almost becoming its unofficial ‘ambassador’. In recent years, SBF has supported Solana and helped the project to grow. This close relationship has contributed to the drop in the price of SOL. Anatoly Yakovenko, founder of Solana, reported on Twitter that Solana Labs has no equity in FTX.

Among the companies that instead have dealings with FTX are venture capital firm Sequoia, which has alerted its shareholders to a $213.5 million exposure in FTX, and Galaxy Digital with $76.8 million. Amber Group said it has 10 percent of its funds locked up on SBF’s exchange, while Crypto.com has $10m (an insignificant amount according to CEO Kris Marszalek). Kraken stated that it has 9,000 FTT tokens but is not in contact with Alameda.

The FTX crisis has mainly affected user confidence, we see the issues raised by the community.

The reaction of the crypto community

The first topic discussed by those in the crypto world is the enormous power CZ and Binance have shown themselves to have over the markets. For some, it was CZ that engineered the whole affair that led to the collapse of FTX, starting with the insolvency rumours circulated. Beyond that, as in the case of Elon Musk and Twitter, CZ’s actions influenced the market. On this consideration, there are those who have dusted off the issue of the crypto world’s cult of personalities, suggesting that what is needed is true decentralisation that does not make the future of projects depend on the decisions of individuals. Isn’t that why Satoshi Nakamoto chose never to reveal his identity?

On the challenge of centralisation versus decentralisation, Stani Kulechov of Aave and Hayden Adams of Uniswap spoke out. The former argued that the only regulation for crypto is decentralised finance itself.

Adams also expressed himself in the same vein: ‘the basic financial infrastructure, such as the ability to exchange value, is too important to be controlled by corruptible centralised entities. This is one of the many reasons why I work on DeFi and decentralised exchanges.

For some, the collapse of FTX was the perfect opportunity to reaffirm the supposed superiority of the ideals of decentralisation. On the other hand, there are those who point out that these ideals at the moment seem to remain unchanged. Even for the most established dapps, security remains a challenge. At the moment, CEXs remain the connecting link between users, cryptocurrencies and traditional systems. It is up to the latter to ensure the security of users through regulations.

Could a single crypto regulation make a difference?

The absence of clear and unique rules for all industry players is another perspective from which to look at recent events. Brian Armstrong, CEO of Coinbase, pointed out that the FTX crisis is a symptom of this lack in the US. A country from which cryptocurrency exchanges flee because of oppressive policies, and that paradoxically find themselves with full freedom once they move abroad.

On the European side, Stefan Berger, a member of the European Parliament’s economic committee, explained that with the MiCA (Market in Crypto Assets) in place, an episode like FTX would never have occurred.

Meanwhile, in a press release from the 10th of November, the California Department of Financial Protection and Innovation announced that it had opened an investigation into the collapse of the FTX exchange.