How can I save money on a new phone or a trip to Spain? Here is a super method to make your wishes come true

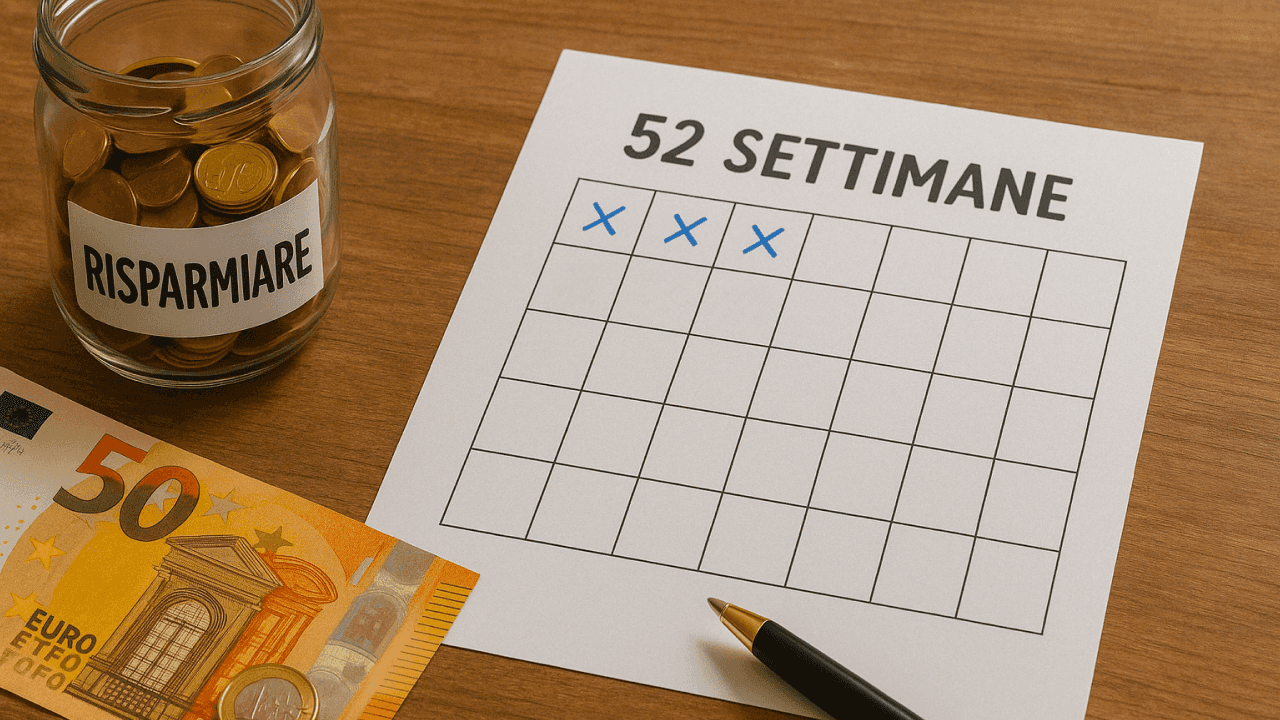

If you’re struggling to save money and create an extra budget for yourself, you’re not alone, and we completely understand. Saving money can be exhausting, requires discipline, and often involves making sacrifices. However, there are strategies that can make this process easier. One effective method is the 52-week challenge, which enables you to save a significant amount of money without even realising it. Here, we explain how it works.

How to save money in 52 weeks: why get involved

Saving money is essential and should be prioritised regardless of circumstances. Starting a savings challenge, like the 52-week money challenge, is beneficial because the perceived effort is minimal compared to the rewards. This challenge’s strength lies in its long-term goal of saving over a year, allowing you to build your savings without significantly disrupting your lifestyle.

Imagine walking past a music shop and seeing a beautiful Fender Stratocaster guitar that you fall in love with. You want it badly, so you go in to ask for the price: €1,149. While this is a substantial amount of money, you set your goal to have the guitar in three months. This means you would need to cut about €400 from your monthly miscellaneous expenses, leading to three months without dining out and strict spending on Friday and Saturday nights.

However, if you extended your savings plan to twelve months, you would only need to save €100 each month, a much smaller figure that has a less significant impact on your lifestyle and, as a result, lowers your perceived effort.

The 52-week challenge outlines a method for saving money without even noticing it.

Saving €1,149 over twelve months is undoubtedly easier than doing so in just three months. The 52-week method is specifically designed to prevent impulse purchases, as it allows for a longer time frame. This is crucial because, as we have discussed in this article, impulse purchases can hinder effective saving strategies. The 52-week challenge divides the savings goal into manageable portions, allowing you to think of it as a prepayment spread out over 52 convenient instalments.

The principle behind this savings method is straightforward yet effective: it involves setting aside an amount of money that corresponds to the week number you’re in. For example, during the first week (week one), you will save €1; in the second week (week two), you’ll save €2; in the third week (week three), €3; and so on, until the last week (week 52), where you will save €52. By the end of the year, you will have accumulated a total of €1,378.

The last month can be particularly challenging, as you’ll need to save around €200. However, you can easily adapt the challenge to fit your needs. For example, you might choose to start from week 52 to tackle the most difficult savings first, double the weekly amounts to reach a total of €2,756, or even shorten the duration based on your specific savings goals. In summary, this system allows for flexibility and creativity, providing a gentle, low-impact way to develop your saving habits.

After learning to save money, make it work for you.

Congratulations! After 52 weeks, you now own a brand new Fender Stratocaster. Unbeknownst to you, this challenge has also helped you develop a valuable skill: the art of saving. Since you’ve gotten into the habit of setting aside money, consider purchasing a larger piggy bank. You can save a portion of your salary each month, not for a specific goal, but simply to build an emergency fund for any unexpected expenses.

However, it’s important to remember that saving faces a hidden threat: inflation, which gradually erodes the purchasing power of your money over time.

To protect yourself against inflation, it’s important to ensure that your money works for you, maintaining your purchasing power over time. For example, if a cup of coffee at a café cost €1 ten years ago, it now averages around €1.20. This means that purchasing power has decreased, as coffee prices have risen by 20%. In other words, inflation has reduced the value of that €1 coin by 20%. How can you beat this challenge? If you’re interested in learning more about it, Young Platform offers a wealth of content on the topic, including an article explaining how to shield yourself from inflation using Bitcoin. Remember, “If you don’t take care of the economy, the economy will take care of you.” So, don’t hesitate—subscribe below to stay informed!