Managing a personal budget is essential for anyone looking to save, invest, or simply gain control over their finances. If you’re wondering how to effectively handle your budget, we’ve compiled a list of the top budgeting apps that make money management effortless. These applications not only simplify tracking expenses but also help you avoid unnecessary spending—essential for those striving for financial security.

Forget about complex spreadsheets! With these apps, managing a budget is easy, enabling you to save more and plan for future investments. Here’s our top five picks for the best budgeting apps in the UK in 2024.

1. Spendee

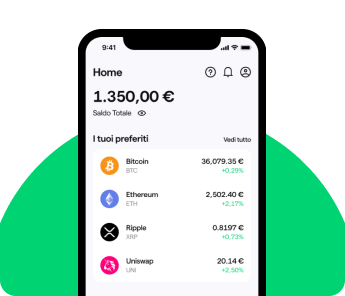

Spendee is a highly effective budgeting app that stands out for its versatility. It enables users to link bank accounts, including some cryptocurrency wallets, making it easier than ever to track transactions and spending. This seamless connectivity means that users can stay updated on their finances in real time, eliminating the need for manual entry.

Spendee provides useful visual aids, such as graphs and dashboards, which offer insights into spending patterns. These tools make it simple to identify where most of your money goes, making it an ideal choice for anyone looking to reduce unnecessary expenses.

Key Features:

- Bank account and cryptocurrency integration

- Customisable charts and dashboards

- Real-time transaction tracking

2. Copilot

Among the top budgeting apps, Copilot is unique due to its integration of artificial intelligence. This app acts as a digital personal finance assistant, offering spending insights and customised budget recommendations. While currently only available in the United States, Copilot has set a new standard for budget apps by providing tailored financial advice on the go.

As a finalist in Apple’s App Store Awards, Copilot’s cutting-edge features make it a standout option. With AI assistance, users gain personalised budgeting tips that help them stay on track with their financial goals.

Key Features:

- AI-powered budget tracking and insights

- Personalised financial advice

- Winner of App Store Awards (US only)

3. YNAB (You Need A Budget)

YNAB is widely considered one of the best budgeting apps for those committed to financial discipline. The app’s core philosophy is to give every pound a purpose, encouraging users to allocate each penny towards specific goals. By dividing expenses into categories—such as savings, bills, or investments—YNAB enables a structured approach to budgeting.

For those who want a comprehensive tool, YNAB is ideal. It includes monthly planning features, educational resources, and workshops on financial literacy. YNAB aims not only to track expenses but also to improve your relationship with money.

Key Features:

- Goal-oriented budgeting for each pound

- In-depth tutorials and workshops

- Monthly planning and detailed budgeting categories

4. Money Manager

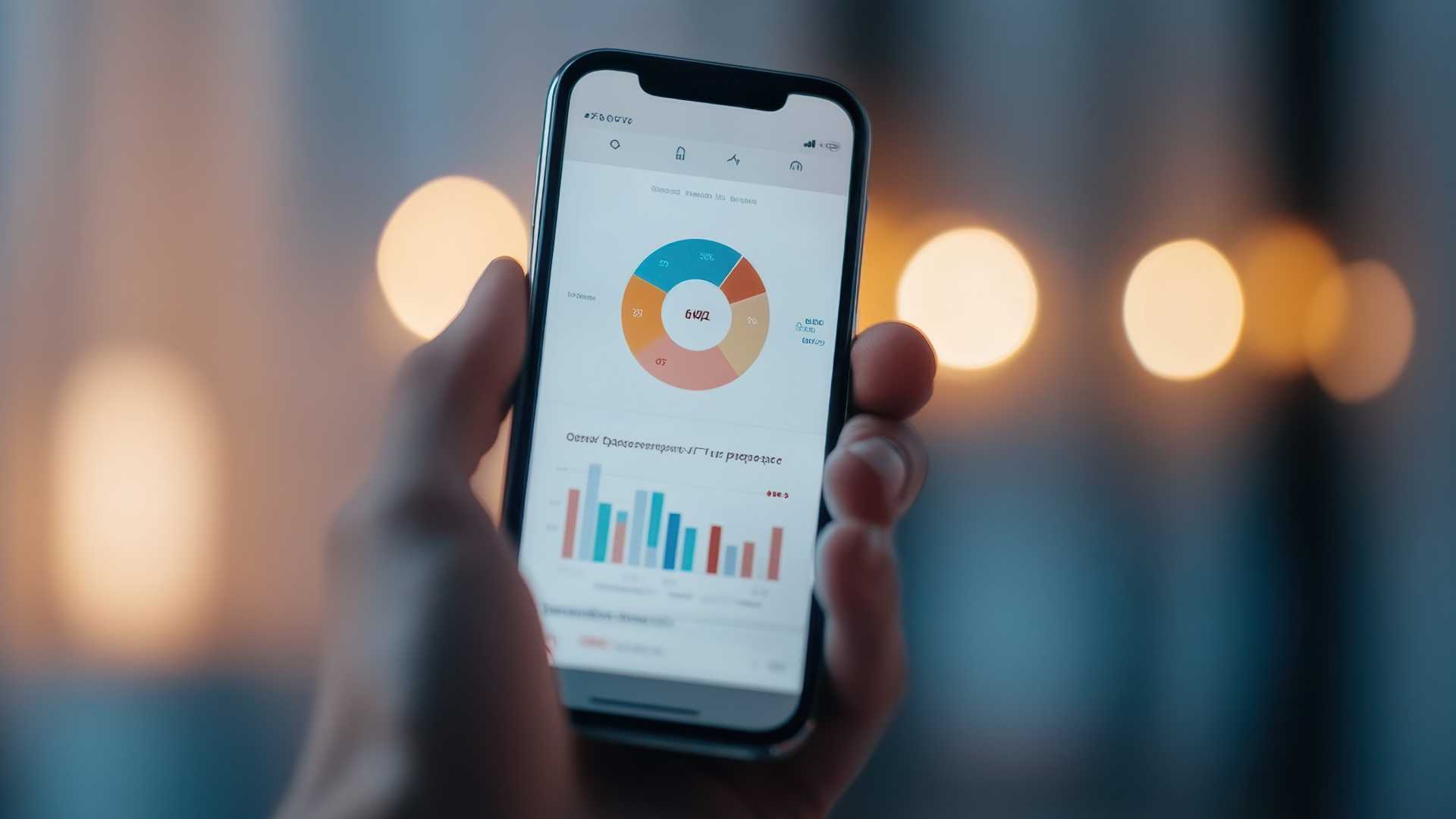

For users who prefer simplicity, Money Manager is an excellent choice. It’s a straightforward budget app that allows for easy logging of daily income and expenses. The app categorises transactions automatically, giving users a clear overview of their spending patterns.

Money Manager provides helpful visual reports, making it easy to identify where you could cut back on spending. This lightweight app is perfect for anyone looking for a no-fuss way to manage their finances.

Key Features:

- Simple transaction logging

- Expense categorisation and visual reports

- Lightweight design, ideal for users wanting a straightforward app

5. Wallet

The final app on our list is Wallet, another great choice among the best budgeting apps in the UK. Like Spendee, Wallet supports automatic bank account linking for real-time expense tracking. Wallet also allows for shared budgeting, which can be handy for families or couples managing joint expenses.

One unique feature of Wallet is its savings goals, where users can set financial milestones and track their progress. Push notifications provide reminders of your financial commitments, helping you stay focused and avoid impulse purchases.

Key Features:

- Automatic bank account linking

- Shared budgeting for group finances

- Savings goals and notifications to keep you on track

Why Use Budgeting Apps?

Utilising one of the best budget apps can make financial management significantly easier. These tools can help you categorise expenses, identify overspending, and set financial goals—all essential for those aiming to boost savings and cut out unnecessary costs. Whether you are looking for a simple tracker or a comprehensive financial planner, there is an app that meets your needs.

With any of these apps, you’ll gain better visibility over your finances, helping you lay a foundation for more informed spending and saving decisions. When your budget is under control, you can consider exploring investments. A practical approach for beginners is recurring purchases, a strategy that allows you to invest incrementally and consistently.

Discover the Moneybox

By choosing the best budgeting app for your lifestyle, you can make financial management more straightforward and enjoyable. Start today with one of these budgeting apps and take the first step toward a secure financial future.