News

Unchanged and Steady: A Deep Dive into the Federal Reserve’s March 2024 Decision

Jacqueline Nieder

5 min

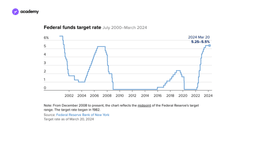

As the curtains fell on the Fed meeting in March 2024, a wave of anticipation gave way to a reality check: the federal interest rates remain unchanged. The current target range is between 5.25% and 5.50%.

The decision, aligned with the expectations set by the Fed’s forecasts, points to a cautious approach despite the clamour for easing monetary policies. But what does this mean for the economy, consumers, and investors? This article delves into the nuances of the Fed’s latest policy stance, dissecting the layers beyond the headline decision.

Market forecast

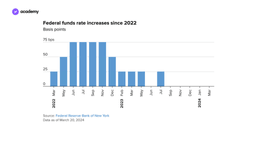

As we stepped into 2024, the investment landscape was abuzz with optimism. Market participants harboured hopes for a series of rate cuts, envisioning as many as six or seven adjustments downward.

However, the tides of economic reality have tempered these expectations. Recent developments and data analyses have led to a revised outlook, with consensus building around three rate cuts anticipated to commence in June. This adjustment reflects a cautious optimism, recognising the persistent challenges of quashing inflation—a nemesis that has proven more resilient than anticipated.

Inflationary trends and economic indicators

Inflation trends remain a critical determinant of the Fed’s policy trajectory. Despite a decline from peak levels, inflation rates, as per the latest Consumer Price Index and Personal Consumption Expenditures Price Index, still overshoot the Fed’s 2% target. Notably, recent monthly data hint at an inflationary uptick, a factor likely weighing heavily on the Fed’s decision-making process. The upcoming PCE index update will be particularly pivotal, offering fresh insights after the March meeting.

Inflationary trends remain a critical determinant of the Fed’s policy trajectory. Despite declining from peak levels, inflation rates increased in January and February, as indicated by the latest Consumer Price Index and Personal Consumption Expenditures Price Index, and are still above the Fed’s 2% target.

Employment data and their implications

The job market’s resilience is a testament to the economy’s underlying strength. However, this robustness also presents a conundrum for the Fed, potentially fueling wage-induced inflation. The recent uptick in unemployment and solid job creation paint a complex picture for policymakers, who must balance curbing inflation and fostering employment.

“A strong increase in hiring per se would not be a reason to hold off on rate cuts,” Fed Chairman Jerome Powell said, adding that the labour market per se is not a cause for concern about inflation.

Details of the March Fed meeting

At the Fed’s March 2024 meeting, members of Congress estimated an overall rate cut of three-quarters of a percentage point by the end of 2024, marking the first decrease since the initial COVID-19 outbreak in March 2020.

The current federal funds rate represents the highest peak in 23 years. This rate determines reciprocal overnight lending costs between banks, affecting different types of consumer debt.

The anticipations concerning the three possible cuts emerge from the Fed’s so-called ‘dot plot’, a set of anonymous forecasts rigorously analysed by the nineteen members of the FOMC. This plot offers no details about the timing of the expected actions.

Federal Reserve Chairman Jerome Powell confirmed that the institution has not yet specified a timeline for the cuts but remains hopeful that they will come to fruition, provided the favourable economic data. After the meeting, the CME Group’s FedWatch index showed that the futures markets attributed a 75% chance to the first rate cut occurring as early as the 11-12 June session.

The committee anticipates three more cuts in 2026, followed by two more thereafter until the federal funds rate stabilises around 2.6 per cent, which officials believe is the neutral, non-incentive or restrictive rate.

These forecasts are part of the Fed’s Summary of Economic Projections, including projections for GDP, inflation and unemployment. The distribution of the data points revealed a more aggressive bias than in December, but without significantly altering the estimates for the current year.

Impact on markets

In response to the Federal Reserve’s decision to hold rates steady, Seema Shah, chief global strategist at Principal Asset Management, said, ‘Powell may have shown his cards: He needs a good reason not to cut rates rather than a reason to cut rates. Markets perhaps couldn’t have asked for more from the Fed, and stocks will celebrate.’

Indeed, the major averages rose on Wednesday afternoon after the Federal Reserve released its policy decision and rate forecast. The S&P 500 gained 0.3 per cent, and the Nasdaq Composite gained 0.5 per cent. The Dow Jones Industrial Average index ended the day up 401 points, or just over 1%. Treasury bond yields mainly fell, with the 10-year benchmark rate recently settling at 4.28%, down 0.01 percentage points.

Conclusion

The Federal Reserve’s latest rendezvous paints a picture of a central bank at a crossroads. Juggling the dual mandates of controlling inflation while fostering employment, the Fed walks a tightrope of monetary policymaking. For consumers and investors, the message is clear: brace for a landscape defined by gradual adjustments and vigilant observation.

The Fed’s strategies and decisions remain pivotal as the economy continues its dance with inflation and growth. With each meeting and announcement, the contours of the economic future gain clarity. Yet, in this era of unpredictability, one truth holds steady: the path ahead is paved with cautious steps and watchful eyes.

You are currently on the Young Platform blog. Keep yourself updated with macroeconomic events directly on the app and observe their real-time impact on cryptocurrency prices.