Bitcoin reached a new all-time high in March. Will it reach $100,000 after the April halving?

What happened in March had never happened in history. The price of Bitcoin had never reached a new all-time high before the halving, scheduled for 19 April (the date may still change).

Since the first target (a new all-time high) has already been reached, it is necessary to identify the next one. In this sense, the most sensible one seems to be the $100,000 mark, a key price zone since the last bullish cycle. According to the Stock-to-Flow model, it was the ‘final’ target for Bitcoin’s price.

Will BTC reach $100,000 after the next halving? We try to answer this question by analysing the halving mechanism, what happened during past cycles and the macroeconomic situation.

Buy Bitcoin!

Halving as a ‘marketing move’

In the past, every halving has had an impact on the price. Not only does the event lead to a reduction in BTC issuance, but it halves it. Certainly, the decrease in Bitcoin’s inflation, which currently stands at around 1.7% and will fall to 0.85% after halving, impacts the asset’s value, especially in the long term. However, the effect this event has on the price of BTC is also different.

Specifically, it can be understood as an arguably unintentional ‘marketing strategy’ of Bitcoin’s creator, Satoshi Nakamoto. This is because Nakamoto designed Bitcoin’s blockchain so that the halving happens suddenly, catalysing attention and stimulating debate around the cryptocurrency.

In fact, the decrease in BTC issuance does not occur gradually, as is the tokenomics of many other cryptocurrencies, but every 210,000 blocks, i.e. about four years.

In this way, halving becomes, by necessity, a major event that every industry enthusiast eagerly awaits. But that is not all. Due to its periodic and regular nature, this mechanism not only punctuates the cyclical price movements of BTC but also attracts the attention of the mass media and individuals hitherto opposed to this technology.

Faced with this scenario, the days leading up to halving represent a potentially strategic moment for those considering buying but cannot decide on the best time.

Buying Bitcoin now could allow you to position yourself before the combined effect of reduced issuance and increased interest drives possible price appreciation. While the exact outcome of the halving remains uncertain, history suggests that the event could be followed by an upward phase, making these last few days an opportunity for those wishing to buy BTC to consider it carefully.

C

Follow the Bitcoin price!

The possible imminent interest rate cut

The upcoming halving of Bitcoin comes at a particularly relevant time in history from a macroeconomic point of view. Mainly because interest rates are expected to be cut by the major central banks, including the Federal Reserve (FED) and the European Central Bank (ECB), presumably starting in June.

This scenario could act as a catalyst for assets considered more volatile or risky, such as equities and, in particular, Bitcoin and other cryptocurrencies. In an environment where high-interest rates offer attractive returns, investors, and significantly institutional investors, tend to prefer safer investments such as government bonds or government securities.

However, as interest rates and, consequently, the yields offered by these instruments fall, capital shifts towards riskier but potentially more profitable assets.

This context of falling interest rates opens the door to increased interest from institutional investors in the cryptocurrency market, particularly Bitcoin.

In addition, the recent introduction of Spot ETFs on Bitcoin has proven to significantly impact the price of BTC, further underlining the importance of institutional investment in the sector. These instruments offer a more accessible and regulated means for these actors to access the cryptocurrency market, acting as a bridge between the traditional financial and cryptocurrency worlds.

Consequently, this scenario sets the stage for a potential bullish rally for BTC. Investors attentive to these macroeconomic and market dynamics might find an additional motivation to consider Bitcoin as an integral part of their portfolio in this context.

Bitcoin’s price after halving in history

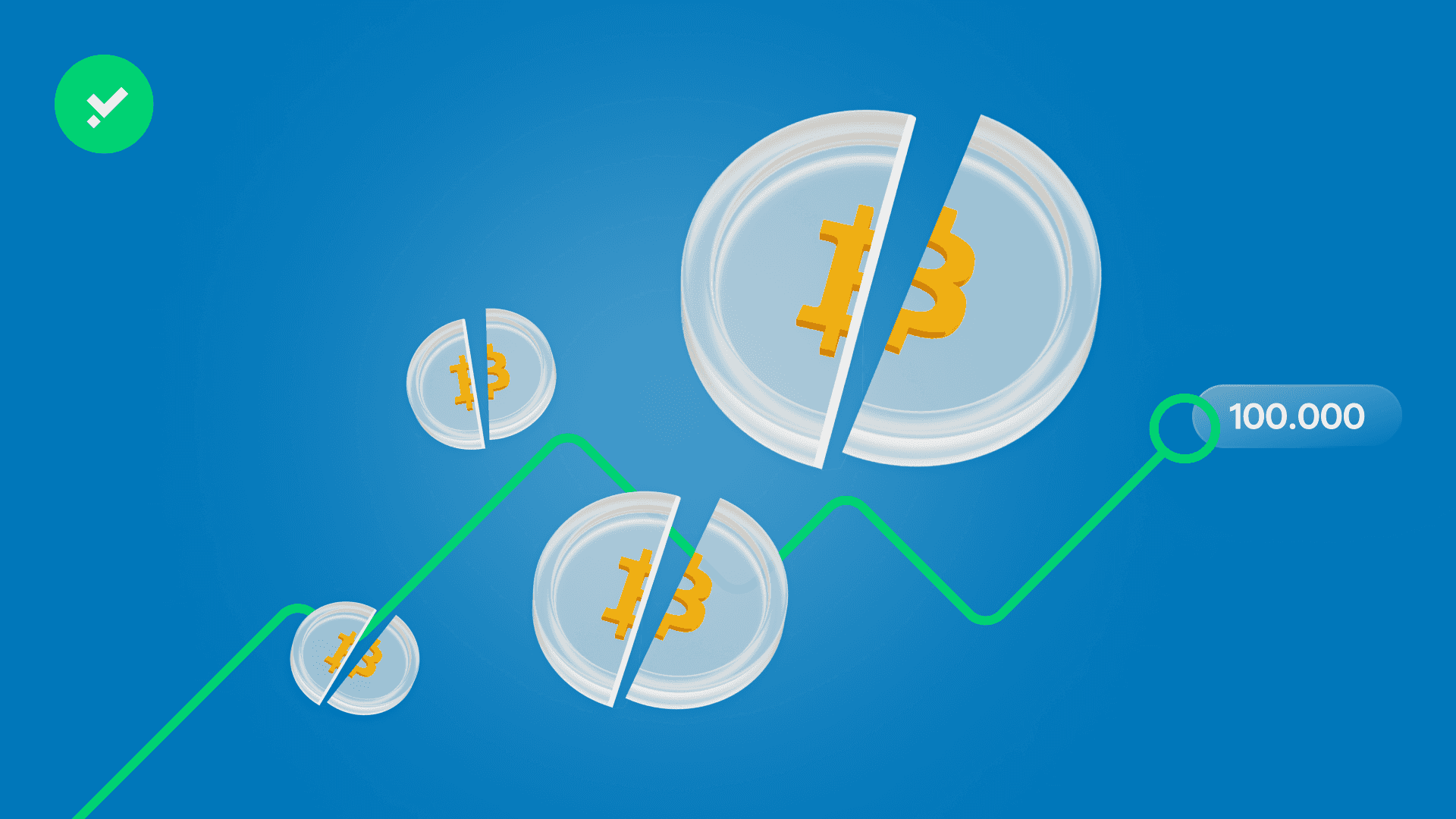

Finally, to estimate the impact of halving on the price of Bitcoin it may be useful to look back. How has halving affected the price of BTC in past bull markets? To oversimplify the question and provide a straightforward answer, halving has always had a positive impact.

In the months following the first halving in history, which took place on 28 November 2012, the price of Bitcoin rose from a price of $12 to a high of around $1,000.

The following year (2016) also positively affected Bitcoin’s price action; the value of BTC reached the historic $20,000 level from the $650 level.

The last halving in 2020, although it generated a lower price increase than previous halvings—740% compared to 2,900% in 2016 and 8,300% in 2012—allowed Bitcoin to reach an all-time high of $64,000. On 11 May 2020, the day Bitcoin’s issuance halved, the price of BTC was $8,000.

What will happen in the coming months? Will the halving, cutting of interest rates, adoption of spot ETFs, and thus the entry of institutional investors contribute to Bitcoin’s price increase?